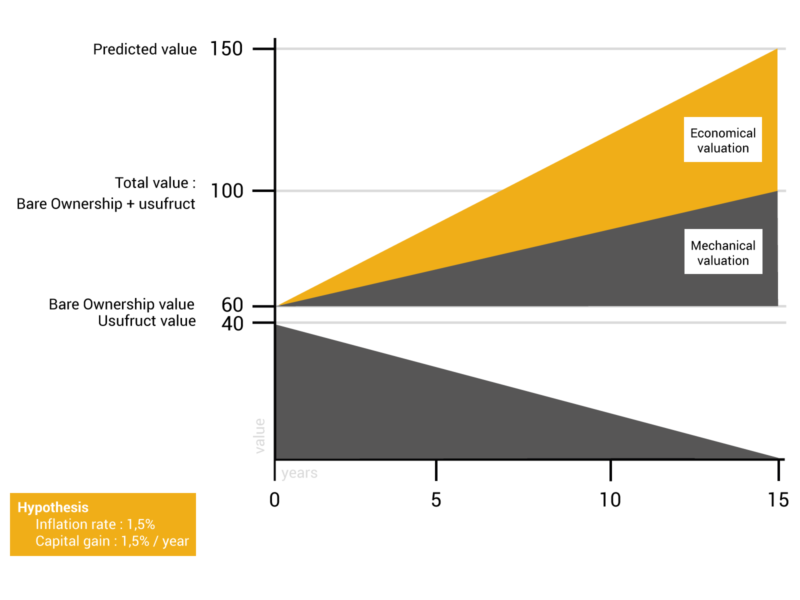

An investor acquires a well-located quality property for 50 to 60 % of its value, in bare ownership. At the same time, the usufruct is acquired for a fixed term (15 to 17 years) by an institutional landlord who rents out the property to households subject to conditions on income*. Over the whole period, the landlord is responsible for all costs, maintenance and taxes. At the end of the usufruct, the investor automatically and free of charge recovers full ownership of your property, maintained and renovated.

CONCEPT

*65% of French households are eligible.

This type of investment is based on the dissociation in property law, for a contractual period of 15 to 20 years, between the law of usage (usufruct) and the law on capital (bare ownership property). Articles 578 to 624 from the French 1804 Code Civil.

THE ADVANTAGES OF A BARE OWNERSHIP PROPERTY

At the acquisition

- Investment in prime location at 60% of the property value

- Notary fees calculated only on the bare ownership price

- A bare ownership property is not taxable under the French wealth tax (IFI)

During the lease period

- No income or property tax to pay

- No maintenance or repair costs to pay

- All rental associated risks are eliminated

- Maintenance and renovation costs are the responsibility of the institutional landlord

- No minimum duration of ownership is required. At any time, you can sell the property bare and keep the tax advantages acquired.

At the end of the lease

- The lease is automatically terminated and the full property given back to you (Article L253-4 Construction and habitation Code)

- At the end of the lease, it is up to you whether you sell, rent or occupy the property

- If you decide to sell, capital gain tax is calculated on the value of the property reunited so the tax is greatly reduced.

OPTIMISED VALUATION

INVESTOR’S PROFILE

Cash-rich looking for a secured long-term property investment

Either looking at capital gain tax or having a second home in a prime location

Looking at investing in a property abroad but without any risk and costs